We believe it is important for patients to be educated about all aspects of their hearing care.

As you may already know, Medicare does not cover the cost of hearing aids. It never has. Capital Hill has discussed the issue, yet no action has been taken. What if you do not have Medicare or are too young for Medicare? How are you supposed to pay? Does insurance cover the cost? Does Medicare cover hearing aids? And why not?!

The short answer is: usually insurance companies do not pay for hearing aids. There is a longer answer, which follows. You didn’t really think you were going to get off that easy, did you?

Working at Hears to U, I have called to check insurance benefits for a number of patients. Medicare does not cover the cost, as mentioned. That also means, that if a patient with Medicare also has a supplemental policy, that policy will not cover the cost. Supplemental policies only cover the costs left over by Medicare. For instance, Medicare only pays for 80% of a covered cost; an office visit for instance. Your supplemental policy will cover the remaining 20%. If Medicare is not involved, neither is your supplement.

However, said your insurance company. We will offer you a “discount” or they cover it as a “Co-Pay”. But, you must go to one of their providers in their network, otherwise known as a third-party administrator (TPA). A few insurance companies (both for-profit and not-for-profit) got together with hearing aid manufacturers (definitely for-profit) and created these third-party administrators or have joined forces with the TPA. Red flag! A manufacturer of medical equipment and an insurance company meant to pay for that equipment working together: a potential conflict of interest.

How do they work you ask? A patient goes to one of these locations (provider) and is given a choice of two hearing aids. They are the same make and model, but one has more advanced technology. You have TWO choices. TWO!? Businesses do this for cost savings or some other hidden reason, plus they can try and “upsell” you to a better device but be careful, there could be a “bait and switch” mentality going on here.

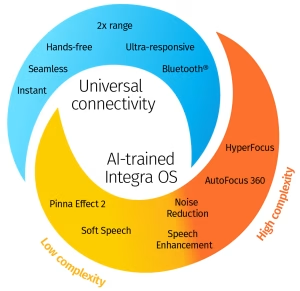

Truthfully, there are dozens of makes and models of hearing aids on the market. Each one is somewhat unique, with various qualities of sound, levels of technology, different features to offer benefits, with rechargeable batteries and some with Bluetooth technology and some without. The aid also needs to address your degree and type of hearing loss. The list is nearly endless. It is a process to choose the hearing aid that works best for you. There is no “one size fits all”; or in this case: one of two sizes fits all.

That is just one of the issues. These aids still cost between $1400-$2000 per pair; not an inconsiderable amount for most. So, you made your choice. They fit the aid and you walk out the door. Then two weeks later, they are not working well. You go back and there is nothing they can do. The providers have signed agreements with the third-party administrator that they can’t switch them out and try to keep the sale as is.

And who is this provider? Are they good at what they do? The provider usually can offer free services for a brief 3 visits and then the cost is back on you, the consumer. The provider won’t do best practice services unless they share this with the patient and get paid more for their time. The fee that the third-party administrator is small. Medicaid payment is almost better. So the patient is usually annoyed and tries find someone else who can help and pay for their services. We see many patients after they got this benefit.

True that some people are happy. Perhaps their hearing loss is milder, or they came across a good provider or the option of the two aids fit their needs. But even if that is good, people need to take a stand and push back against this unethical and perhaps illegal system that is creating.

Or, you go back after two weeks, because you do not like the way they sound. Your own voice is too loud in your head, other people sound “tinny”. So sorry, this is the aid you chose. Now you have two hearing aids that you paid a fair amount of money to purchase and they are sitting in a drawer. You cannot hear, you are not happy, and not anxious to go somewhere else.

While it is not really a “benefit” to the patient, it is not for hearing care providers either. They have to sign a contract with these TPAs that prohibits them from discussing good points and bad points of this “benefit”. What is essentially a “gag order” between a provider and patient rarely works well for the patient. It is unethical. Insurance companies and hearing aid manufacturers have no business dictating the content of a consultation between a provider and a patient.

For those providers who refuse to be a part of this, like us, that kind of pricing cannot be duplicated. The pricing set by the insurance company and manufacturer working together is less than what can be purchased by an independent clinic; even at wholesale prices. This undercut price makes it impossible for small businesses to compete.

So who does benefit from this “benefit”? The insurance companies and the hearing aid manufacturers. Unfortunately, an uneducated consumer is shopping only for the price tag. They do not understand the difference between all these makes and models. There is a lack of understanding that these third-party administrators do not have their best interests in mind. They are selling thousands of units and making a profit off of the sheer volume of units sold. Never mind about consumer confidence and trust.

While there is the old saying: “You get what you pay for”, price is a consideration for all of us. No one wants to pay more than they need for a quality product. That is why things are different at Hears Hearing & Hearables and our new E-commerce store Hears Hearing & Hearables. We allow people to “demo” hearing aids, so they know which make and model is best for their hearing loss, their perception of sound, and in what type of situations they want to hear better. It is a process, no doubt. We offer payment plans and competitive pricing. We sometimes even have used hearing aids for sale that is just what the doctor ordered. 🙂

So next time someone asks you “Does Medicare cover hearing aids?”, you will be equipped with the knowledge and understanding of the systems at play. Thank you for reading and educating yourself on this topic as it is an important one for us at Hears Hearing & Hearables.

Hears Hearing & Hearables is a membership store. It is a group of like-minded patients, professionals, and staff, all dedicated to hearing health care. We fund ourselves, with no venture capitalist investment. The more our membership grows, therefore the louder our voice will be.

Please ask us about it and join now! And providers, Join the movement.

Cheers, Karen and Kim

Powered By SinglerDesign.com