In the realm of hearing healthcare, being well-informed about available choices for treatment is crucial. This blog explores the distinctions between UnitedHealthcare benefits for hearing aids and UnitedHealthcare Hearing supplements. It sheds light on various aspects, including the merger between Epic Hearing and United Healthcare Hearing. As well as their intriguing ownership by Sonova, a prominent hearing aid manufacturer.

UnitedHealthcare, a significant player in health insurance, offers a range of benefits. Regarding hearing aids, UnitedHealthcare sometimes provides hearing aid coverage on their non-Medicare, traditional plans. This coverage is based on the individual policy and plan. These true insurance benefits typically cover a pair of standard hearing aids every three years up to an allotted amount. Usually somewhere between $1000 – $5000. Benefits like this offered by UnitedHealthcare enable individuals to access essential auditory devices and choose any provider contracted with UHC. This traditional approach offers policyholders flexibility in choosing from a variety of hearing aids that best suit their needs and preferences without forcing them into using a third-party administrator like UnitedHealthcare Hearing.

A significant development in the hearing healthcare landscape was the merger between Epic Hearing and UnitedHealthcare Hearing. This union aimed to enhance the overall hearing care experience for consumers. However, delving deeper into the implications of this merger, especially considering the subsequent ownership structure, is crucial.

Epic Hearing Care and UnitedHealthcare Hearing, both operating as third-party administrators (TPAs), play pivotal roles in the realm of hearing care services. Notably, the history of UnitedHealthcare Hearing involves a significant development through its merger with Epic Hearing Care.

This union brought together two influential entities with the shared goal of enhancing the overall hearing care experience for consumers. As a result of this merger, UnitedHealthcare Hearing solidified its position as a key player in administering hearing care benefits.

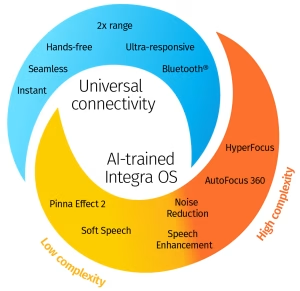

The collaboration also introduced a unique ownership structure, with Sonova, a leading hearing aid manufacturer, overseeing the operations. In this capacity, Epic Hearing Care and UnitedHealthcare Hearing, as TPAs, navigate the landscape of hearing care benefits, managing claims, coordinating services, and ensuring that policyholders can access the resources needed for their hearing health.

Through their roles as intermediaries, these TPAs connect individuals with hearing care coverage. However, this coverage is limited to hearing providers contracted to these third party services.

UnitedHealthcare Hearing stands out due to its ownership by Sonova, a leading hearing aid manufacturer. This ownership dynamic influences the products and services offered. The emphasis on a specific hearing aid, the “Relate,” raises questions about transparency and choice within the UnitedHealthcare Hearing supplement framework.

The merger between UnitedHealthcare Hearing and Epic Hearing Care, with ownership by Sonova, raises concerns about transparency in the relationship between an insurance company and a hearing aid manufacturer. A significant issue revolves around the covered benefit through this policy. Primarily centered on the “Relate” hearing aid, a brand owned by Sonova. The lack of transparency becomes evident as the focus on promoting a specific product may limit the choices available.

The singular focus on promoting the Relate hearing aid may raise concerns among consumers seeking a broader range of choices. The lack of transparency in pushing a specific product could potentially limit options for individuals seeking hearing solutions through United Healthcare Hearing supplements.

This emphasis on a particular brand within the UnitedHealthcare Hearing supplement framework raises questions about monopolies and the resulting impact on consumer choice. Monopolies, especially in healthcare, can stifle competition and negatively affect small businesses and provider autonomy. In this context, the dominance of a specific hearing aid brand may create a less competitive market. Therefore limiting options for customers and potentially hindering the growth and innovation of smaller hearing aid manufacturers.

The lack of choice for customers within the UnitedHealthcare Hearing supplements, where the covered benefit is closely tied to Sonova’s product, may have broader implications. It not only affects consumers seeking various options but also places constraints on hearing healthcare providers. These professionals may find their autonomy compromised as they are constrained in recommending a diverse range of hearing aids that cater to individual needs. The restrictive nature of the coverage may discourage competition and innovation in the hearing healthcare industry. Ultimately affecting both consumers and providers.

Furthermore, the impact of this ownership structure extends to audiologists who play a crucial role in providing quality hearing healthcare. Alleged lack of adequate compensation for audiologists may discourage them from continuing to see patients. This presents a challenging scenario where both the hearing provider and the consumer are affected.

During a recent conference, I engaged in discussions with two colleagues specializing in managed care patients. Their confirmation aligned with my observations, revealing a tendency to consistently fit the same hearing aid as restricted by the managed care relationship on every patient. However, the providers saw this as convienent and simplifying their workday. The managed care program eliminated their concerns about implementing new technology, providing choices, and even seeking out new patients through marketing efforts and advocacy work.

As an advocate for individuals with hearing loss, I find this approach detrimental to both the provider and the ethical standards of our profession. It not only compromises the quality of care provided but also raises concerns about professional ethics and the commitment to delivering personalized solutions tailored to the diverse needs of each patient.

In conclusion, the lack of transparency in the relationship between an insurance company and a hearing aid manufacturer, coupled with a focus on a specific product, raises concerns about monopolies and the resulting impact on customer choice, small businesses, and provider autonomy. Striking a balance between promoting competition, fostering innovation, and ensuring transparent relationships is crucial to maintaining a vibrant and consumer-friendly hearing healthcare landscape.

Powered By SinglerDesign.com